Experience the freedom of accessing your account wherever you are.

- It’s Simple: enhanced user experience with a whole new look and feel and quick action buttons for popular functions.

- It’s Secure: from logging in using your fingerprint to managing your access code, we’ve made your mobile banking experience totally secure.

- It’s Convenient: access your account from any mobile device anywhere, anytime.

- Transfer funds

- Check balances and account history

- eStatements: view and print monthly statements

- eAlerts: get notified of important account activity

- Bill Pay: pay your bills online.

- Make loan payments

- Stop checks

- Order checks

- View and print check images

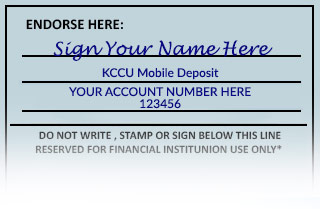

Remote Deposit Capture (RDC)

- Sign the back of the check with your signature

- Write “For mobile deposit only at KCCU” on the back of the check

- Write your account number on the back of the check

- Login to MYKCCU Mobile

- Choose the account you want the deposit to go int

- Enter the dollar amount of the check

- Take pictures of the front and back of the check

- Submit the Check for Deposit

KCCU NetBranch

KCCU Bill Pay and iPay QuickPaySM

KCCU Bill Pay

Pay your bills online from your free KCCU checking account AND use your voice to pay your bills with iPay QuickPaySM

Use your voice to pay your bills with iPay QuickPaySM

iPay QuickPay is the skill that lets you access your bill pay account on your Alexa-enabled device — all with a simple voice command. You can ask Alexa to make payments, provide your payment history and check your scheduled payments.

You can even make person-to-person payments using iPay QuickPay. Simply add the person as a payee in your bill pay account and then you can tell Alexa who to pay and when.

KCCU Estatements

Secure estatements reduce clutter and your risk for ID Theft. Login to your account and view your statements online.

MasterCard Online Acccess

Order Checks Online

ATM Finder/Service Center Locations

Auto Resources

Personal Finance

Credit Lock with Lock & Alert

Lock and unlock your Equifax credit report right from your phone. Once the report is UNLOCKED, the creditors will be able to then gain access to your credit file.

Fraud Helpful Resources

Equifax:

www.equifax.com

888-548-7878

Security Freeze:

www.freeze.equifax.com

800-685-1111

800-349-9960 (NY residents)

TrustedID Premier:

www.trustedid.com

Lock & Alert:

https://lockandalert.equifax.com

Experian:

www.experian.com

888-397-3742

TransUnion:

www.transunion.com

800-680-7289

Fraud Victim – Placing an Alert

Equifax: 1-800-525-6285

Trans Union: 1-800-680-7289

Experian: 1-888-397-3742

*Consumer only needs to contact one of the three bureaus. They will share the consumer’s alert request with the other two bureaus.

- Initial Fraud Alert – stays on file for 1 year

- Extended Fraud Alert – stays on file for 7 years – creditor must contact consumer at phone number listed on file that was given when fraud alert placed on the file. A valid police report is required in order to place the extended alert. Consumer’s name is removed from prescreened credit offers for 5 years.

- Security Freeze – Consumers can place a security freeze on their file – costs vary by state. The file will remain “frozen” until the consumer requests it be temporarily or permanently removed. When a file is frozen creditors are unable to obtain a copy of the consumer’s report. (It can take up to 3 days to “unfreeze” a file).

Pre-Approved Credit Solicitations

To opt out of national credit solicitations: www.optoutprescreen.com

- Equifax: 1-888-567-8688 (press 2)

- Trans Union: 1-800-241-2858

- Experian: 1-800-353-0809